2021 w4 calculator

Check if Nonresident Alien. Deadline for Stimulus Check.

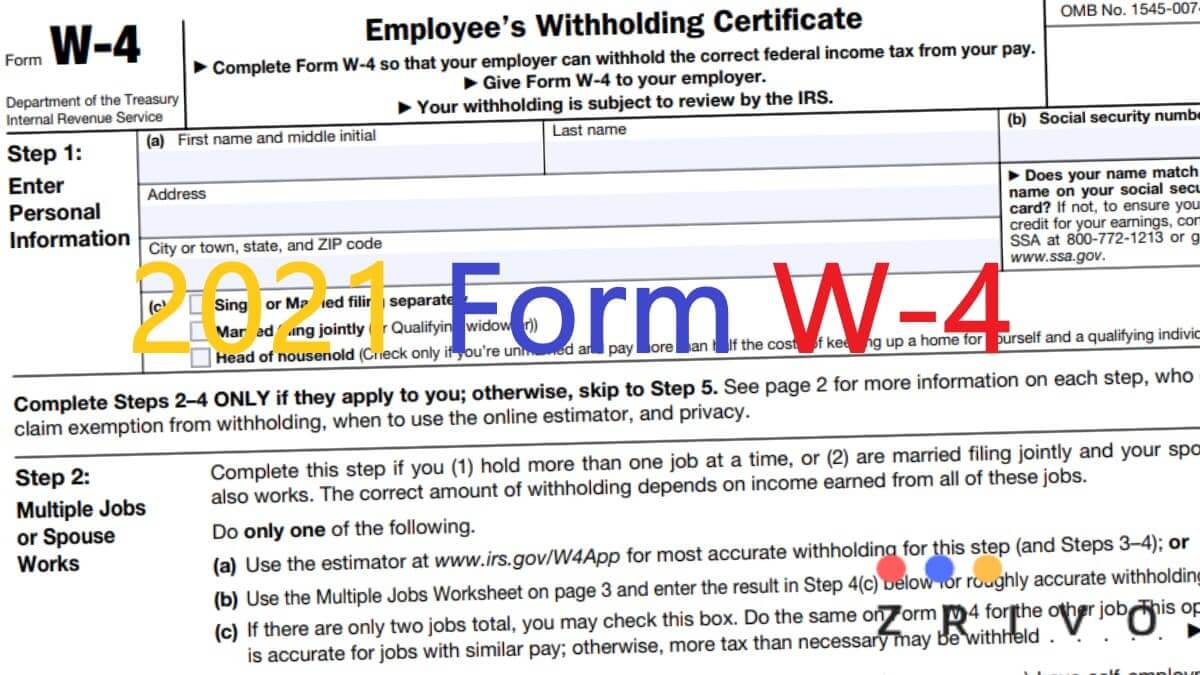

W4 Form 2021

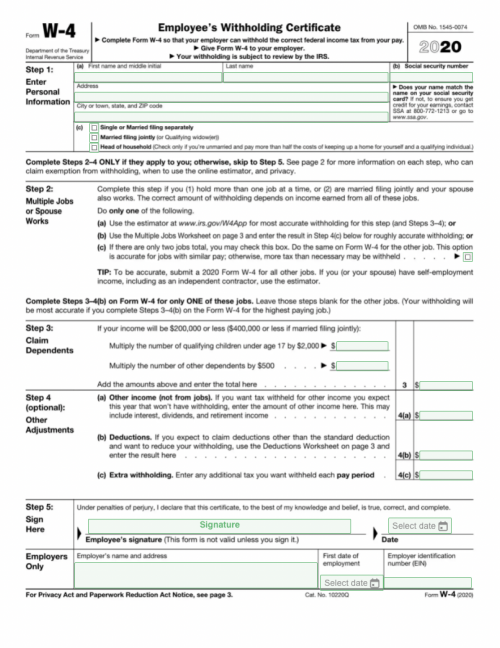

2020 Paycheck Calculator based on New W4 Form.

. Top End W8 Option available with 6 Airbags All 4 Disc Brakes ESP Traction Control offering best. Instead you fill out Steps 2 3 and 4. How FICA Tax and Tax Withholding Work in 2021-2022.

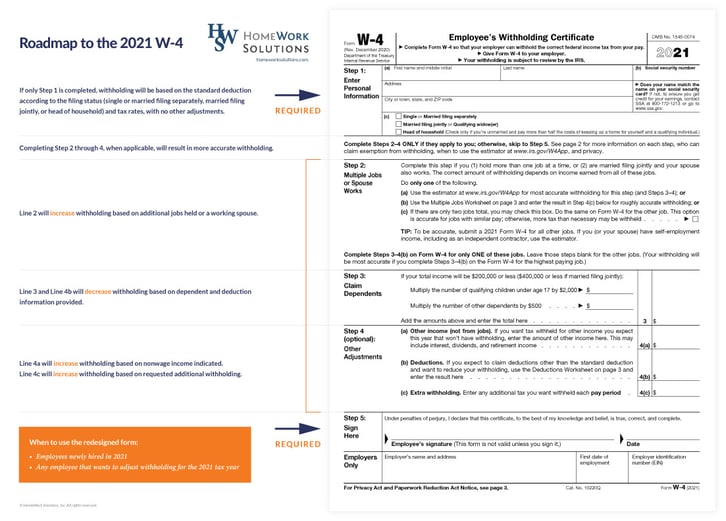

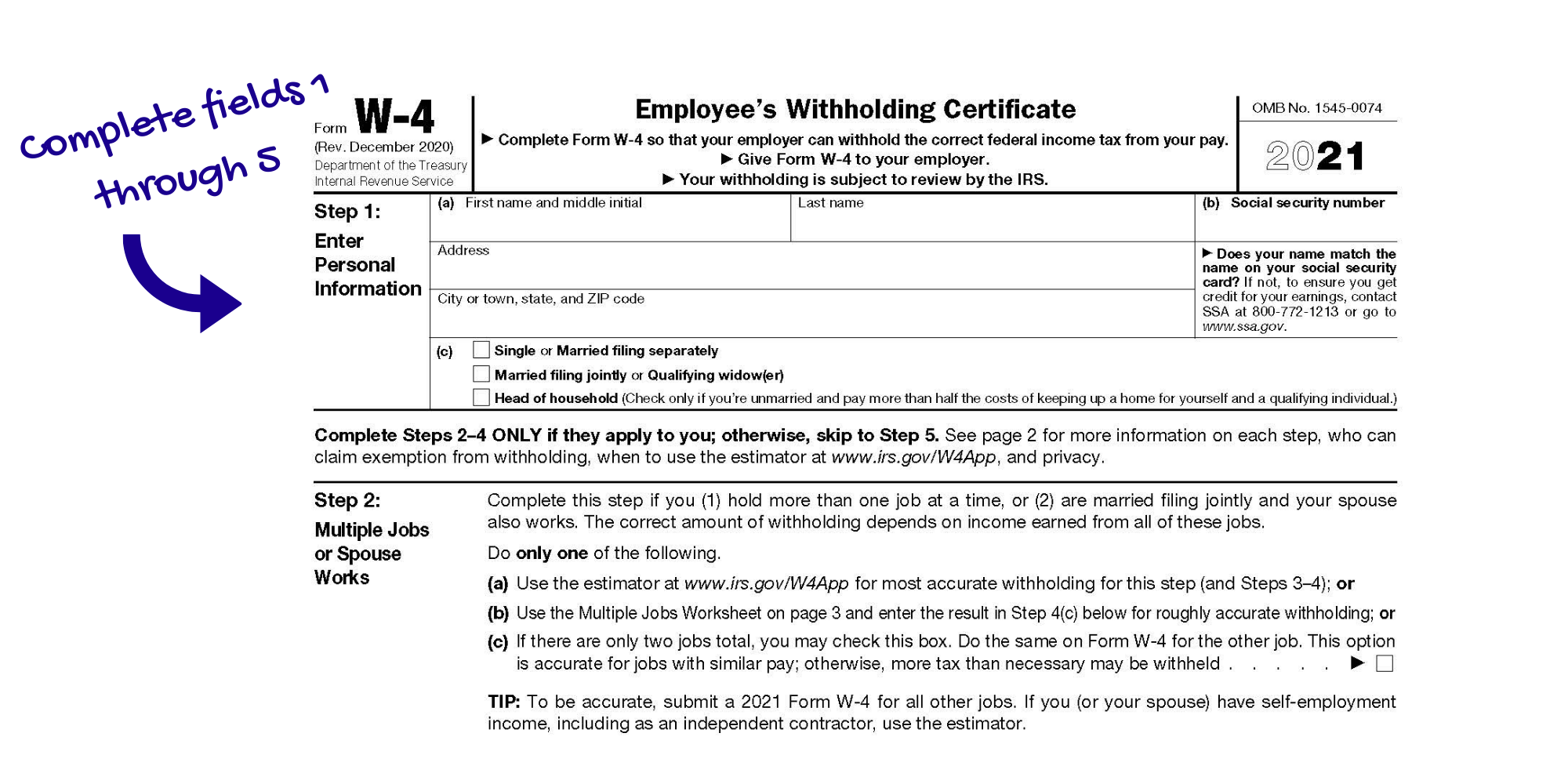

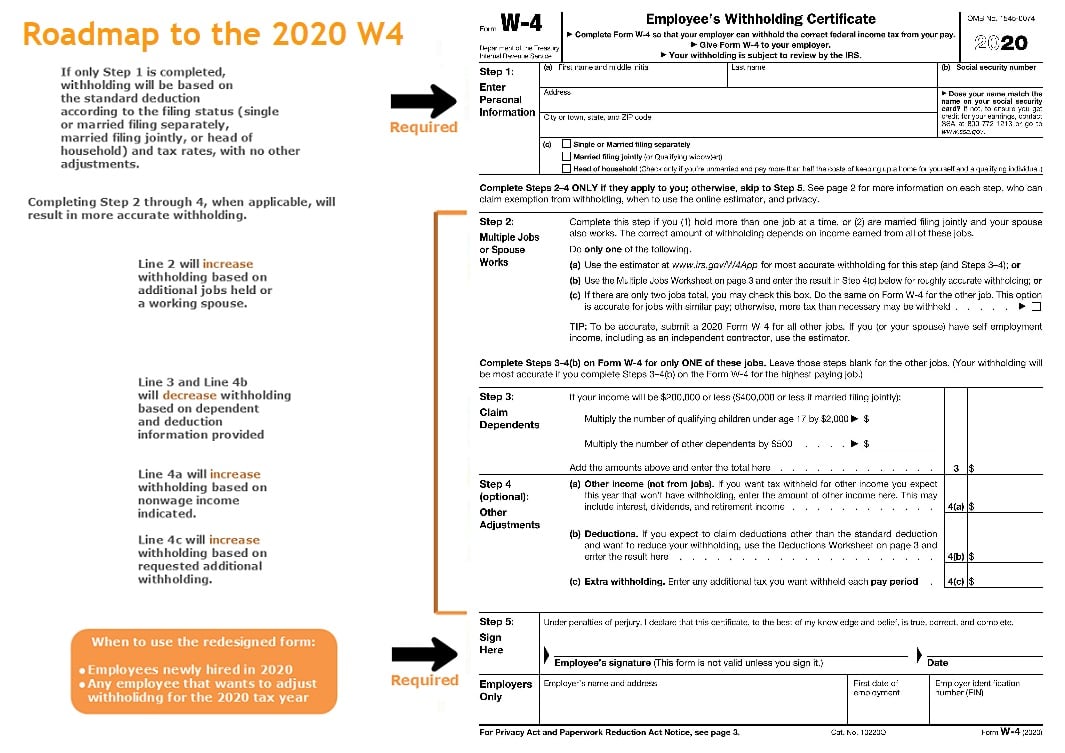

2022 Prompt Submission of Employee Withholding Allowance Certificate. The Withholding Form. Use our W-4 calculator and see how to fill out a 2022 Form W-4 to change withholdings.

Or keep the same amount. 505 to see whether the amount being withheld is comparable to the projected total tax for the year. Explanation of Your W2.

Your total tax on line 24 on your 2021 Form 1040 or 1040-SR is zero or less than the sum of lines 27a 28 29 and 30 or 2 you were not required to file a return because your income was below the filing threshold for your correct filing status. Will the amount of money earned from investments and dividends affect the W-4. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

The IRS classifies investments and dividends as nonwage income. Our free W4 calculator allows you to enter your tax information and adjust your paycheck withholding to increase your refund or take-home pay on each paycheck by show you how to fill out your 2020 W 4 Form. Instead you fill out Steps 2 3 and 4.

Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Maximize your refund with TaxActs Refund Booster. TaxAct 2021 Professional 990 Enterprise Edition.

Federal W4 Withholding Status W-4 Cheat Sheet. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

TaxAct 2021 Professional 990 Edition. Car Prices in Delhi Loan Eligibility Calculator Hot Car Deals EMI Calculator. A list of all state agency resources and benefits can be found atPhone.

The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4 calculator tool for you. And if her situation doesnt change in 2021 her refund will actually grow to 20584. The home office deduction calculator is the easiest way to find out how much home office deduction Also read the frequently asked questions on office deduction.

If your personal or financial situation changes for 2022 for example your job starts in summer 2021 and continues for all of 2022 or your part-time job becomes full-time you are encouraged to come back in early 2022 and use the calculator again. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Handy tips for filling out W4 online.

To change your tax withholding amount. The two examples above are. No the calculator assumes you will have the job for the same length of time in 2022.

If youre changing your allowances part-way through the year and you claimed too many allowances for the first part of the year use the online calculator to determine the additional amount you need withheld to make up for the shortage you had during the first part of the year. Welcome to Mycarhelpline Community Blog. All Variants as base W4 Variant scored 5 Star in Global NCAP.

After You Use the Estimator. IRS tax forms. If yes visit.

Uncle Sam might owe Margaret 14465 when all is said and done. Ever served on active duty in the United States Armed Forces. Adjust your W-4 withholdings to get a bigger tax refund or a bigger paycheck.

Form 1040 may help you estimate your 2021 AGI. If you have not yet filed a 2020 Tax Return or generally dont file taxes at all you can file your 2020 Return if you need to claim Stimulus 1 andor 2You can no longer receive the advance payments through 2021 - claim your full credit amount by e-filing a 2021 Return in 2022. Form MO W-4 Revised 08-2021 Form.

Go digital and save time with signNow the best solution for electronic signaturesUse its powerful functionality with a simple-to-use intuitive interface to fill out W 4 form online design them and quickly share them without jumping tabs. 2021 2022 Paycheck and W-4 Check Calculator. See more information on the advance CTC payments.

University of Maryland Employees. The TCJA eliminated the personal exemption. Filing Form W-4 and Address Change.

Form W-2 Wage and Tax. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Free Federal and New York Paycheck Withholding Calculator.

Free Federal and State Paycheck Withholding Calculator. Everyones tax situation is unique and any online tax refund calculator will at best provide you with a rough estimate of how much youll get back. How to claim it on your 2021 Return details and.

Home Office Deduction Calculator 2021. By Prashant Thakur On August 4 2020 At 539 am. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit.

Once your W-4 form takes effect you can use the IRS withholding calculator on IRSgov or reference Pub. Awarded Safer Car for India Award. Now you can easily create a Form W-4 that reflects your planned tax withholding amount.

10000 20000 30000 40000. Dormogovmilitary to see the services and benefits we offer to all eligible. Check if You have filled out the Latest W4.

Use your estimate to change your tax withholding amount on Form W-4. Printing and scanning is no longer the best way to manage documents. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Payroll check calculator is updated for payroll year 2022 and new W4. Another word for beautiful place. TaxAct 2021 Tax-Exempt Organizations Edition.

How To Fill Out 2021 2022 Irs Form W 4 Pdf Expert

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Federal And State W 4 Rules

New W4 For 2021 What You Need To Know To Get It Done Right

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate 2021 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Form W 4 2017 Irs Tax Fill Out Online Download Free Template

How To Fill Out A W 4 Form In 2022 Indeed Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

W 4 Form What It Is How To Fill It Out Nerdwallet

Federal Withholding Canon Capital Management Group Llc

New W4 For 2021 What You Need To Know To Get It Done Right

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Solved 2020 W 4

W 4 Form Basics Changes How To Fill One Out

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms

Irs Improves Online Tax Withholding Calculator